Plumbing Fixtures Depreciation Life . If you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you must use the. Understanding the rules and exceptions for claiming capital improvements for plumbing is crucial to maximizing your tax. Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping). The fixed asset useful life table becomes an essential tool in systematically tracking and managing the depreciation of. Understanding furniture and fittings useful life. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Plumbing is depreciable under the modified accelerated cost recovery system (macrs).

from www.chegg.com

Understanding furniture and fittings useful life. If you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you must use the. Understanding the rules and exceptions for claiming capital improvements for plumbing is crucial to maximizing your tax. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Plumbing is depreciable under the modified accelerated cost recovery system (macrs). The fixed asset useful life table becomes an essential tool in systematically tracking and managing the depreciation of. Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping).

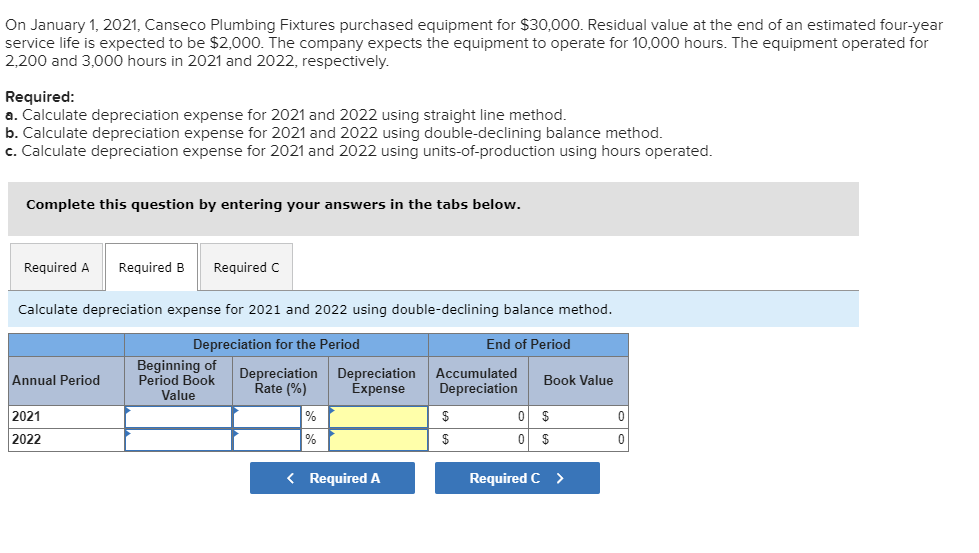

Solved On January 1, 2021, Canseco Plumbing Fixtures

Plumbing Fixtures Depreciation Life If you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you must use the. If you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you must use the. Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping). Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. The fixed asset useful life table becomes an essential tool in systematically tracking and managing the depreciation of. Understanding furniture and fittings useful life. Plumbing is depreciable under the modified accelerated cost recovery system (macrs). Understanding the rules and exceptions for claiming capital improvements for plumbing is crucial to maximizing your tax.

From www.haynearchitects.com

Tips & Tricks Calculating Minimum Plumbing Fixtures Required with Plumbing Fixtures Depreciation Life The fixed asset useful life table becomes an essential tool in systematically tracking and managing the depreciation of. Plumbing is depreciable under the modified accelerated cost recovery system (macrs). Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Understanding furniture and fittings useful life. Understanding the rules and exceptions for claiming capital improvements. Plumbing Fixtures Depreciation Life.

From enginediagramsophie55.z19.web.core.windows.net

Electrical Wiring Depreciation Life Plumbing Fixtures Depreciation Life Understanding furniture and fittings useful life. Understanding the rules and exceptions for claiming capital improvements for plumbing is crucial to maximizing your tax. Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping). Plumbing is depreciable under the modified accelerated cost recovery system (macrs). The fixed asset useful life table becomes an. Plumbing Fixtures Depreciation Life.

From homedesignideas.help

Plumbing Fixtures Definition And Examples BEST HOME DESIGN IDEAS Plumbing Fixtures Depreciation Life Plumbing is depreciable under the modified accelerated cost recovery system (macrs). Understanding furniture and fittings useful life. If you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you must use the. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. The fixed asset. Plumbing Fixtures Depreciation Life.

From www.chegg.com

Solved On March 31, 2024, Canseco Plumbing Fixtures Plumbing Fixtures Depreciation Life Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Understanding the rules and exceptions for claiming capital improvements for plumbing is crucial to maximizing your tax. Understanding furniture and fittings useful life. The fixed asset useful life table becomes an essential tool in systematically tracking and managing the depreciation of. If you figured. Plumbing Fixtures Depreciation Life.

From willsanellis.blogspot.com

Heavy equipment depreciation calculator WillsanEllis Plumbing Fixtures Depreciation Life Understanding furniture and fittings useful life. Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping). If you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you must use the. The fixed asset useful life table becomes an essential tool in systematically. Plumbing Fixtures Depreciation Life.

From plumbjoe.com

Plumbing Fixtures & Appliances Lifespan, Depreciation & Resale Value Plumbing Fixtures Depreciation Life Understanding furniture and fittings useful life. Plumbing is depreciable under the modified accelerated cost recovery system (macrs). If you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you must use the. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Plumbing components that. Plumbing Fixtures Depreciation Life.

From bullardkhan.com

How to Calculate MACRS Depreciation (2022) Plumbing Fixtures Depreciation Life Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Plumbing is depreciable under the modified accelerated cost recovery system (macrs). Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping). If you figured depreciation using the maximum expected useful life of the longest lived item. Plumbing Fixtures Depreciation Life.

From goodbeeplumbinganddrains.com

Plumbing Fixtures vs. Fittings GoodBee Plumbing Plumbing Fixtures Depreciation Life Plumbing is depreciable under the modified accelerated cost recovery system (macrs). Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Understanding the rules and exceptions for claiming capital improvements for plumbing is crucial to maximizing your tax. The fixed asset useful life table becomes an essential tool in systematically tracking and managing the. Plumbing Fixtures Depreciation Life.

From plumbjoe.com

Plumbing Fixtures & Appliances Lifespan, Depreciation & Resale Value Plumbing Fixtures Depreciation Life Understanding the rules and exceptions for claiming capital improvements for plumbing is crucial to maximizing your tax. The fixed asset useful life table becomes an essential tool in systematically tracking and managing the depreciation of. Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping). Depreciation is the systematic allocation of the. Plumbing Fixtures Depreciation Life.

From plumbjoe.com

Plumbing Fixtures & Appliances Lifespan, Depreciation & Resale Value Plumbing Fixtures Depreciation Life Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. The fixed asset useful life table becomes an essential tool in systematically tracking and managing the depreciation of. Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping). Understanding the rules and exceptions for claiming capital. Plumbing Fixtures Depreciation Life.

From www.chegg.com

Solved On January 1, 2021, Canseco Plumbing Fixtures Plumbing Fixtures Depreciation Life Understanding furniture and fittings useful life. Plumbing is depreciable under the modified accelerated cost recovery system (macrs). Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping). Understanding the rules and exceptions for claiming capital improvements. Plumbing Fixtures Depreciation Life.

From houseofhargrove.com

NEW HOUSE PLUMBING FIXTURES House of Hargrove Plumbing Fixtures Depreciation Life The fixed asset useful life table becomes an essential tool in systematically tracking and managing the depreciation of. Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping). If you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you must use the.. Plumbing Fixtures Depreciation Life.

From www.bmtqs.com.au

Fixtures & Fittings Depreciation Rate BMT Insider Plumbing Fixtures Depreciation Life Understanding furniture and fittings useful life. Understanding the rules and exceptions for claiming capital improvements for plumbing is crucial to maximizing your tax. Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping). The fixed asset useful life table becomes an essential tool in systematically tracking and managing the depreciation of. Plumbing. Plumbing Fixtures Depreciation Life.

From www.chegg.com

Solved On January 1, 2021, Canseco Plumbing Fixtures Plumbing Fixtures Depreciation Life Understanding the rules and exceptions for claiming capital improvements for plumbing is crucial to maximizing your tax. Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping). Understanding furniture and fittings useful life. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Plumbing is depreciable. Plumbing Fixtures Depreciation Life.

From www.studypool.com

SOLUTION Plumbing fixtures Studypool Plumbing Fixtures Depreciation Life Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping). If you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you must use the. Plumbing is. Plumbing Fixtures Depreciation Life.

From www.chegg.com

Solved On January 1, 2021, Canseco Plumbing Fixtures Plumbing Fixtures Depreciation Life Understanding furniture and fittings useful life. Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping). If you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you must use the. Plumbing is depreciable under the modified accelerated cost recovery system (macrs). Depreciation. Plumbing Fixtures Depreciation Life.

From homedesignideas.help

Plumbing Fixtures Definition BEST HOME DESIGN IDEAS Plumbing Fixtures Depreciation Life Plumbing components that are used to provide general building services (e.g., drains, valves, restroom plumbing fixtures and piping). The fixed asset useful life table becomes an essential tool in systematically tracking and managing the depreciation of. Understanding the rules and exceptions for claiming capital improvements for plumbing is crucial to maximizing your tax. Understanding furniture and fittings useful life. Plumbing. Plumbing Fixtures Depreciation Life.

From www.chegg.com

Solved a. Sold at a gain of 7,000 furniture and fixtures Plumbing Fixtures Depreciation Life Plumbing is depreciable under the modified accelerated cost recovery system (macrs). The fixed asset useful life table becomes an essential tool in systematically tracking and managing the depreciation of. Understanding furniture and fittings useful life. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Plumbing components that are used to provide general building. Plumbing Fixtures Depreciation Life.